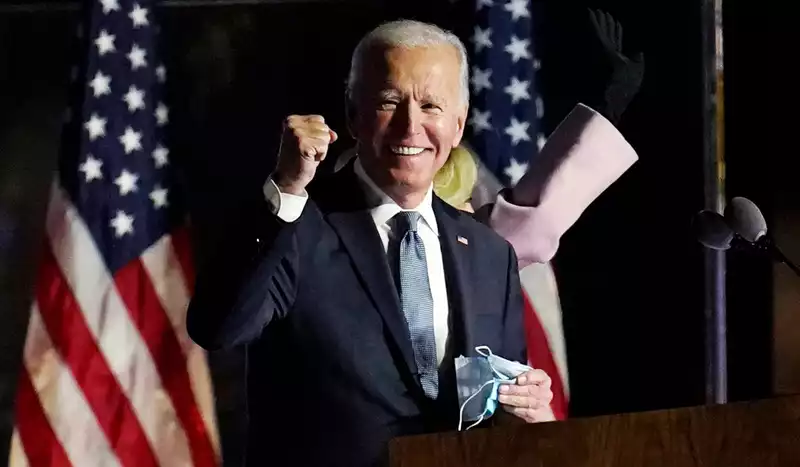

President Joe Biden is scheduled to unveil his "American Families Plan" this Wednesday, April 28, and while Americans should not expect a fourth stimulus package, there are several provisions that could bring further fiscal relief.

The $1.8 trillion proposal, which is expected to be announced before the president's address to Congress on Wednesday evening, is said to extend the expanded child tax credit included in the administration's stimulus package passed earlier this year.

The credit, up to $3,600 per dependent child per year, was originally set to begin in July and expire at the end of the year. The proposed extension would run through December 2025, providing a four-year deduction worth up to $16,200 per dependent child. This deduction existed prior to the stimulus bill, but was capped at $2,000 per child per year.

This is quite a relief for families, but if you don't have children, Biden's latest plan still offers some benefits.

In addition to the child tax credit, families may be eligible for assistance with child care costs and paid parental leave, although the amount and duration of these benefits are not yet known. Biden has also proposed a free universal pre-kindergarten.

Families without children could take advantage of two years of free community college attendance. The plan also reportedly includes an expansion of the Affordable Care Act to help individuals purchase health insurance.

Some Democrats have called for further strengthening of health care benefits. A group of 17 senators, including Senators Bernie Sanders (R-Vermont) and Elizabeth Warren (R-Massachusetts), recently sent a letter to the administration calling for changes in Medicare eligibility and benefit caps.

Specifically, the senators asked Biden to lower the Medicare eligibility age and to include hearing, dental, and vision benefits in his Medicare plan.

The path to passage of this relief measure is not entirely clear, but it is unlikely to pass Congress without some changes. In any event, it is hoped that the final bill will provide some benefit to individuals and families.

Comments